What are the best metrics for SaaS Companies to track?

You have a great SaaS business. Now, which metrics should you be tracking for your SaaS company to make the most impact?

What specific SaaS metrics help you analyze your data and help guide your decisions in the future?

Knowing these metrics will provide insight into the intricacies of tracking growth and help you reveal the benefits SaaS companies utilize regardless of their size and market position.

What is MRR? What is ARPA? Is churn not something you do to make butter?

In this post, we will define 10 of these terms and give examples.

We do not want just to show what they are, but also why they are important and how you can use these metrics to fix problems or track success in your SaaS business.

1. MRR (Monthly Recurring Revenue)

MRR, or Monthly Recurring Revenue, is a vital metric for SaaS businesses with the subscription model. Once someone subscribes, you have new recurring revenue and, consequently, a new metric to track.

MRR Formula

MRR = number of customers * average billed amount

You determine your MRR by totaling your monthly revenue from subscriptions. More often than not, startup costs and fees are not accounted for in the MRR metric, which is something to keep in mind.

MRR comes with both benefits and costs. An advantage is that, once someone subscribes, there is no worry about one-off selling. MRR helps you track the month-to-month revenue easily because it’s predictable.

Every SaaS company should live and die by MRR, because that’s something that you can’t go without.

Mamoon Hamid

Social Capital

Now, let’s look at a more informative list so you can better compare the pros and cons:

What are the costs of MRR?

- Churning

- Increased demand for customer retention

- Potential delay in ROI

What are the benefits of MRR?

- Creates a predictable monthly revenue stream

- Enables community involvement and promotes a loyal fanbase

- Shows the strengths and weaknesses of sales

- Helps create reliable business decisions based on results

For example, you can’t download the entire Netflix catalog and access the services offline because your not purchasing and licensing the software directly. MRR is a vital metric for Netflix to track because they are required to maintain the software.

MRR is the most important metric for financial growth. There are other important metrics like growth rate, retention, average sales price, and rep productivity, but at the end of the day, the most important metric is the amount of monthly recurring revenue customers are willing to put on their credit card or pay through an invoice

Dan Tyre

Sales director @HubSpot

2. Churn

When making butter, churning is part of the process. The same applies to SaaS companies. Let me explain.

What is Churn?

Simply put, churn is the loss of subscribers. Let’s face it. You are going to lose some customers. Accounting for that loss allows you to see what is going wrong and how you can improve your customers’ retention.

This is the reason the churn metric is important for SaaS companies.

Two types of Churn are vital to SaaS companies. Customer Churn and Revenue Churn. While both are important and connected, they play different roles in business decisions.

Customer Churn

Customer churn is the loss of customers. If you are using a yearly subscription model, it is best to note these losses every month or quarter. Finding out why these subscribers canceled their subscriptions gives valuable information to improve customer retention.

Are customers canceling their subscriptions because it isn’t of any use to them? Did they have a problem with customer service? Taking account of the different personalities, needs, and wants of lost subscribers saves you from inevitable catastrophes in the future.

HubSpot wrote an insightful article titled: Customer Churn: 7 Tips to Stop the Attrition.

Here are some of the key takeaways and an outline of the reasons customers churn:

Reasons for churn

- Pricing: is it genuinely worth the cost?

- Product-market fit: does the product truly fit the market and help solve a real problem?

- User experience: is your product buggy, glitchy, or crashing?

- Customer experience: did your customer have a bad experience or your support was unresponsive?

- Under-appreciated brand values: do your values not align with the market?

- Competitor intervention: are you keeping up with your competitors?

- Plateaued growth: are you moving towards profit over customer growth?

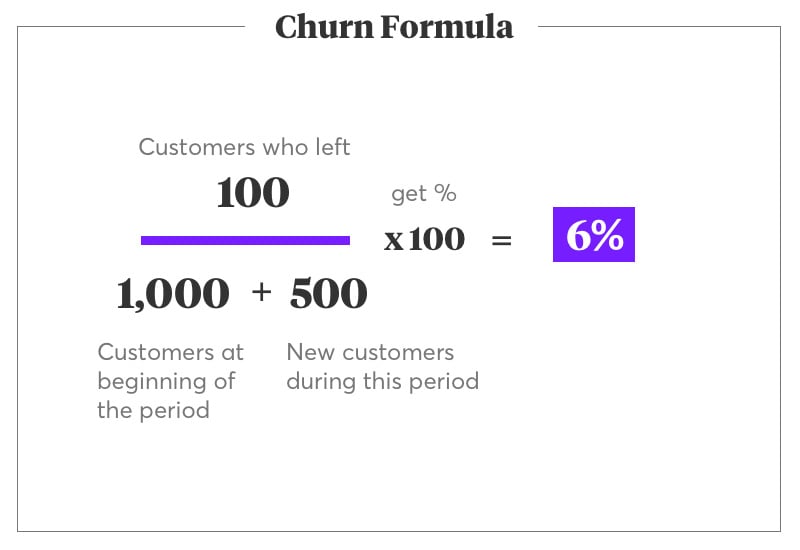

To calculate customer churn, simply take the number of people that canceled their subscription for the month, quarter, or year.

HubSpot writer Sofia Bernazzani recommends monthly or quarterly calculations and a more in-depth look at the customer count.

If your retention is poor then nothing else matters.

Brian Balfour

Founder/CEO of Reforge & Former VP Growth at HubSpot

You can get the churn rate by taking the total number of churned customers and dividing them by the total number of customers from last month, quarter, or year.

Churn Rate = Total # Churned Customers / Total # Customers of Previous Month

Revenue Churn

Revenue churn is just as important as customer churn. While it is important to track customers that are leaving, which subscription they were also using matters.

If there is a variable option for subscriptions, tracking revenue churn can show which plan or subscription is churning the most.

For example, a business has a $100 option and a $200 option for their subscription plan. If more people are canceling the $100 subscription vs. the $200 subscription, you can change something to retain more users or try upselling them with the $200 subscription.

Revenue churn can potentially point you in the direction of a problem. Either the prices or the features need readjusting.

3. ARPA (Average Revenue per Account)

It is crucial to know which products customers enjoy and produce revenue and which products they avoid. You can track growth and revenue on a unit-by-unit basis through an understanding of the ARPA metric.

ARPA is the Average Revenue per Account. This metric for SaaS companies can also be the Average Revenue per User or Unit. Tracking your ARPA is beneficial for investors to find products that generate strong revenue.

How do you Track ARPA?

You can track your ARPA by taking your MRR (listed above) and dividing that by the number of customers you have. Tracking your ARPA can be done on your billing cycle, be that annually, quarterly, or monthly.

ARPA Formula

MRR / # of Customers = APRA

New vs. Existing Accounts

While tracking ARPA, new and existing accounts will be mixed. It is beneficial to separate these two into Average Revenue per New Account and Average Revenue per Existing Account. This allows you to compare the behavior of new customers currently learning the product vs. existing customers that already have a grasp of the product.

The way to calculate both of these remains the same. The only difference is that you divide the work for more data.

4. LTV (Customer Lifetime Value)

What is the potential value of a customer? It depends on how long they stay subscribed. Finding out the Customer Lifetime Value, or LTV, gives you the average financial value of a specific customer or an average customer.

How to Calculate LTV

To calculate your LTV, you will need three metrics. These are the following:

- churn rate

- customer lifetime rate

- ARPA

First, find the customer lifetime rate. This can be found by taking the number 1 and multiplying it by your churn rate. For example, if you have 20 customers and lose 1, your churn rate is 5%, and your customer lifetime rate would be 20 (1 / .05 = 20)

Second, find your average revenue per account (ARPA). This can be done by taking your total revenue, or MRR, and dividing the total number of customers you have. For example, if your revenue is $50,000, divide it by 20 customers. The ARPA is then $2,500 (50,000 / 20 = 2,500).

Last, your LTV will be your ARPA multiplied by your customer lifetime rate. In this example, our LTV is $50,000 (2,500 x 20).

LTV Formula

ARPA multiplied by your customer lifetime rate

An LTV gives you information on the worth of an average customer. You must account for this SaaS growth metric because you want to know how much an average customer gives you over the lifetime of their involvement. It allows you to make financial, marketing, and customer service decisions. Also, it can impress investors with the value of your company.

A useful practice is to increase ARPA (customers paying more) and to retain more customers (reduce churn).

Here are some questions you should ask yourself after evaluating the LTV metric:

- Which customers should you spend your marketing resources on?

- Who are your best customers?

- How much time and resources should you spend on acquiring a new customer?

- Who do you tailor your service to?

5. CAC (Customer Acquisition Cost)

You have to spend money to make money. Hearing this can cause heads to turn. CAC, or Customer Acquisition Cost, tracks the amount you spend on average to acquire a customer.

You pay for ads, you have a sales department with salaries, you sponsor an event. These are all costs to gather new customers. Without customers, there is no business. The cost of acquiring these customers makes up your CAC.

How do you determine your CAC?

When determining your CAC, you first want to total all the expenses to gather customers. Once you have that, divide it by the total number of customers you have. This is similar to finding out your MRR, except with expenses instead of revenue.

CAC Formula

Total Sales and Marketing Expenses / Total # of Customers

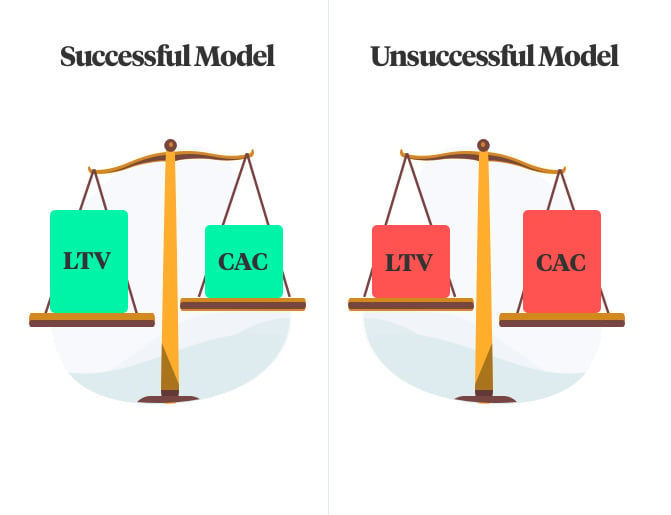

LTV vs. CAC

There is no point in having a CAC without knowing the LTV. This is because balancing the CAC and LTV is crucial for any business. While the LTV shows you the value of a customer, the CAC shows you the cost of one.

For any business, you want the value of the customer to be higher than the cost to acquire one. How much higher is determined on a case-by-case business. See-a-see what I’m saying?

Essentially, the LTV is what you make, and the CAC is what it takes. Because of this, you want to get your CAC as low as possible. It is not so much about the exact numbers, but the ratio between them.

A healthy business should get the ratio of LTV to CAC above 3 (3:1).

Starting a SaaS company with subscriptions, though, is risky. It may take years for you to recuperate the losses on advertising from the monthly, quarterly, or yearly subscriptions you have running.

6. Growth

Growing a company cannot be pegged down to one or a couple of metrics. This is because growth is a general metric that has many factors.

One way of determining growth is by comparing MRR growth YoY (year-over-year). However, you may also want to watch growth month-by-month. Some months out of the year may do better than others. Either way, tracking growth can help you show progress with stakeholders and investors.

7. Profit

Profit is the amount you make after expenses are taken out. While you may be getting new customers, you need to determine if you are making a profit.

For example, in one of the previous sections titled “CAC,” you will find the battle between LTV and CAC. If you are gathering many customers, but your LTV is low, your profits will dip.

Growth vs. Profit

Bigger always means better, doesn’t it? Not exactly. When comparing growth and profit, balancing out the two is the best path. A company can still grow while making no profits.

Tesla has yet to make any profit but is also one of the biggest companies in America. This is because they grew exponentially but did not worry about profits. This is beneficial for SaaS companies.

As a SaaS company, you want to try monopolizing your market. So, taking a hit in the first couple of years is not a bad idea when you are aiming for exponential growth. Just make sure to temper that growth later into your journey.

8. Expansion Revenue

I know what you’re thinking. “Now that I know these definitions, so what? What do I do with them?” That is a good question that can be answered with expansion revenue.

Now that you have a SaaS business and are looking up metrics, how do you make the SaaS growth metrics work for you? For example, what do you do about churning?

Expansion Revenue helps you track customers who are upgrading their subscriptions to more expensive plans.

The goal is to get your churn rate to a low percentage. However, you can effectively get your churn rate into the negative. A negative churn rate is good. It implies that more people are upgrading than canceling.

David Skok defines a negative churn rate as the event when your upsells, upgrades, etc., exceed your churn losses. Accounting for expansion revenue is beneficial because it effectively ameliorates the revenue lost from churns.

9. NPS (Net Promoter Score)

How do you know if you are marketing your product to the right market? If people keep buying, they must enjoy the product, right? Not exactly.

The NPS, or Net Promoter Score, is a favorable metric because it relays feedback about your product. Have you ever gone to a retail chain and received a receipt with a survey? These retail chains are tracking their net promoter score.

You can create a survey rather quickly with this simple question. “How likely are you to refer your friends and colleagues to our product?” The hard part is getting them to fill out the survey, so they usually offer an incentive.

This metric is beneficial for marketing as well as sales. It is as simple as creating a survey with scores from 1 - 10. Anyone that lists a 6 or below are prime customers to follow up with and learn from their grievances.

While this is less of an equation than previous sections, it is just as helpful.

10. Activation Rate

Have you ever reluctantly hovered on a Netflix series, and you didn’t know if it was good or not? You decide to give it a try; then, after a couple of episodes, you notice that you love it and cannot go without it?

This can be one of the most, if not the most, important parts of running a SaaS company. Let me explain.

That feeling is the “aha” moment when you realize that you need or want the service. This is the activation rate.

More specifically, the Activation Rate is how quickly customers reach that “aha” moment.

This metric takes quite a bit of work to determine. For example, what needs, behaviors, and instructions are needed to learn the product?

When you realize how most customers find that “aha” moment, it’s time to streamline that circumstance. Optimize new customer onboarding so new customers can learn the product quicker and find that “aha” moment faster.

Once customers know how to work the product, it is a lot more likely that they will become recurring customers.

Closing

Now that we have gone through the metrics, what do you do? How do you use this new information?

That is simple! Look for unchurned butter. When you notice that your CAC is too high, you know that the costs of gathering customers are too high or your LTV is too low.

Send out a survey to find out why people are churning and optimize your onboarding. Learn how to upsell/cross-sell so you can increase your expansion revenue.

Should you focus on growth vs. profit, or should you move into profit because growth has plateaued?

Knowing these metrics does not assure you that your business will succeed. However, knowing them will show you why your business is failing or succeeding.

Mastering these metrics improves your problem-solving skills. Good problem-solving becomes good business.

Receive resources directly to your inbox

Sign up to get weekly insights & inspiration in your inbox.